Snap, Crackle, and Slop: OpenAI + SNAP

High level thoughts on how an OpenAI acquisition of SNAP could give them an edge in the Slop Wars

Two days ago I was sitting outside on the deck with a pounding headache, the shrieks of a dozen small children echoing in the background. In a moment of weakness, I ignored the conventional wisdom of modern medicine and popped a handful of extra-strength Tylenol. Thirty minutes later, somewhere between solving the Riemann Hypothesis and re-underwriting Einstein’s theory of relativity, I saw the future of consumer facing AI-generated slop consumption. Thus, the idea for this post was born.

In April 2025, Meta decided that integrating AI directly into Facebook, Instagram, and WhatsApp wasn’t enough so they launched a dedicated standalone AI app called “Meta AI”. A+ on name creativity.

6 days ago on September 25th, Meta doubled down on this strategy by launching “Vibes”, a new feed in the Meta AI app where you can create and share short-form, AI-generated videos.

Then yesterday, OpenAI announced their new social app, “Sora”, a standalone AI app powered by their Sora 2 video and audio generation model. The press release described it as follows:

“Inside the app, you can create, remix each other’s generations, discover new videos in a customizable Sora feed, and bring yourself or your friends in via cameos. With cameos, you can drop yourself straight into any Sora scene with remarkable fidelity after a short one-time video-and-audio recording in the app to verify your identity and capture your likeness.”

And thus, with OpenAI’s official foray into AI-first social app building, the Slop Wars were born.

The core argument of this post is that people don’t want more apps — especially not ones consisting entirely of AI-generated content. AI should be seen as a powerful layer that enhances an experience, not the experience itself. Standalone, AI-only apps introduce friction and redundancy, whereas weaving AI seamlessly into existing platforms reduces barriers and maximizes adoption. Existing scaled distribution matters more than ever for AI deployment.

For example, would anyone care about or use Grok if it wasn’t integrated into the Twitter/X app where 500 million+ monthly active users have easy access to it? I doubt it.

Similarly, Meta obviously drives the vast majority of its AI user interactions via the native AI search within Facebook, Instagram, and WhatsApp that 3.5 billion people access daily, rather than on this new AI-first Meta AI app.

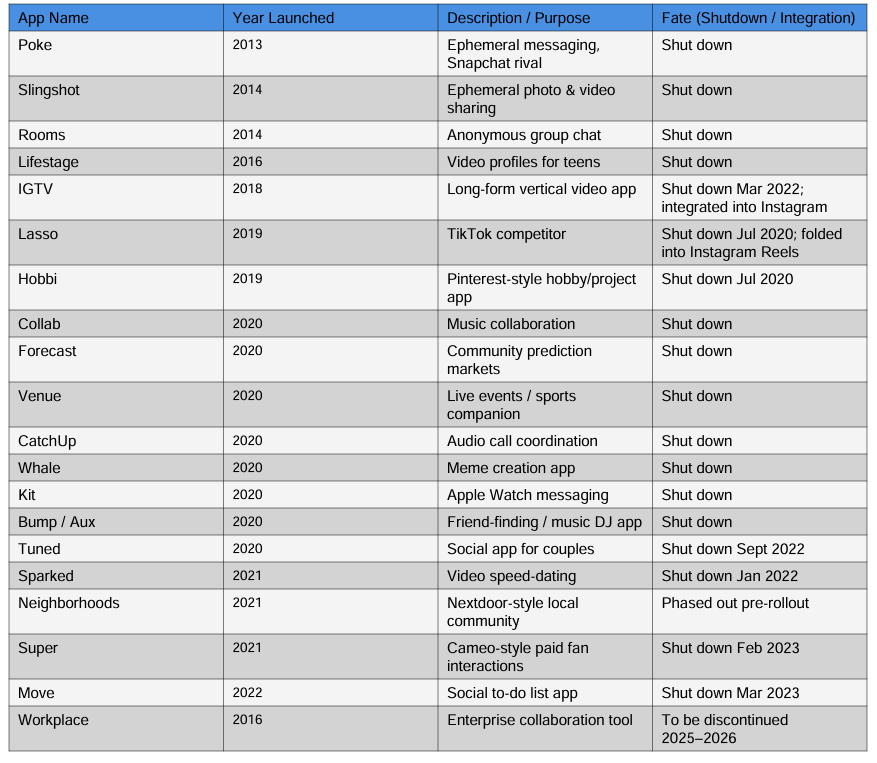

To illustrate that people don’t actually want more standalone apps, consider Meta’s repeated attempts to spin up separate products for experiences that were ultimately better delivered within an existing platform, or already had a superior use case elsewhere.

We see the same pattern across Asia, where “super apps” such as China’s WeChat, Southeast Asia’s Grab, and Japan’s Line have become the primary gateways to a wide range of services, driven by the daily habits of their users.

So why does this matter?

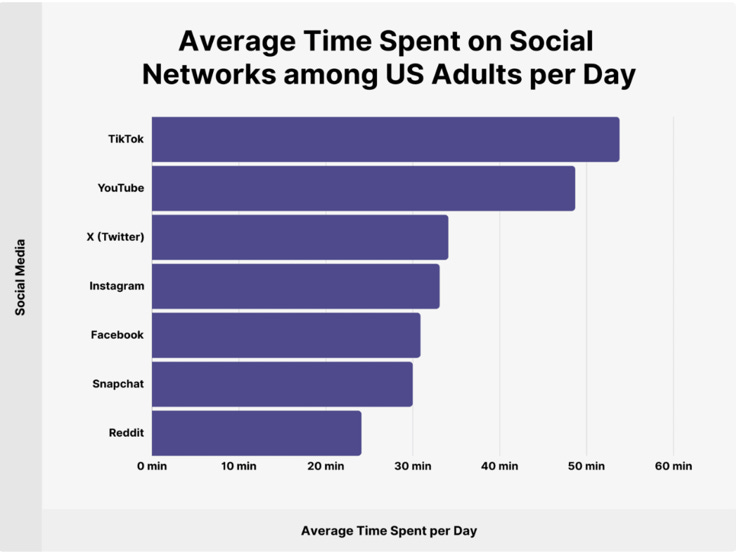

Meta, Alphabet, Netflix, TikTok, Twitter/X, Snap, Pinterest, Reddit, and countless others are all fighting for the same users and the same finite 24 hours in a day. Since usage is the lifeblood of their revenue models, their incentives are clear: get in front of as many people as possible, and keep them engaged for as long as possible. In that context, distribution is everything.

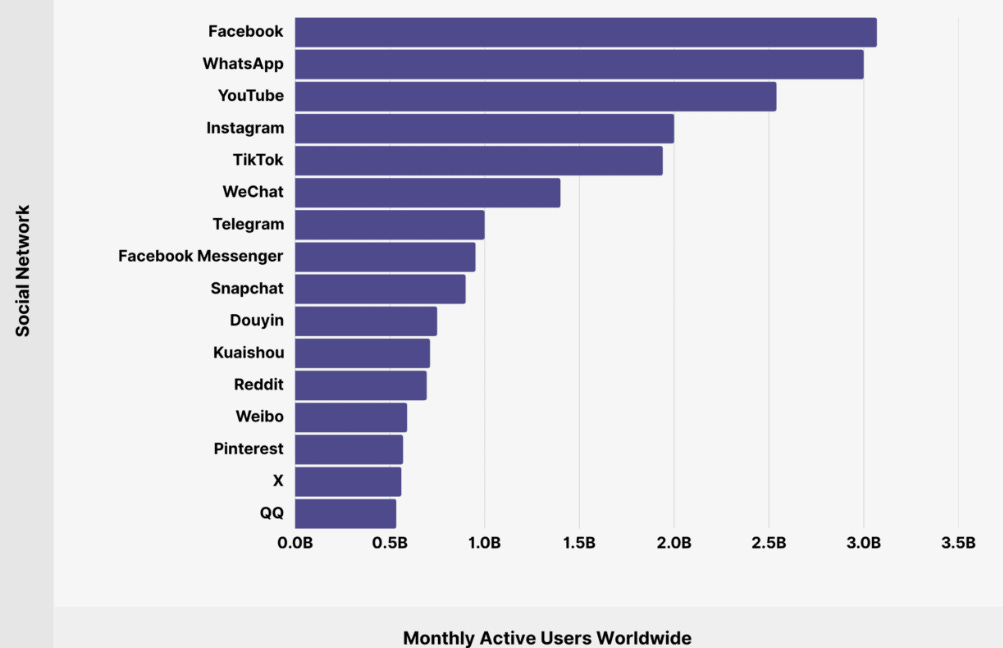

When Meta launches a new consumer facing AI function/offering it has direct access to 3.5 billion people who habitually interface with Meta’s family of apps dozens of times per day.

When Alphabet launches a new consumer facing AI function/offering they have distribution through YouTube, which has nearly 3 billion global monthly active users.

Even a smaller competitor like xAI/Grok has distribution via Twitter/X which has >500 million monthly active users.

With OpenAI’s entrance into the consumer facing social media space, they are arguably operating at a distribution disadvantage when compared to their entrenched competitors. My hot take: the fastest way to close that gap is to acquire Snap, Evan Spiegel’s personal ESOP and the modern day clown car in a goldmine.

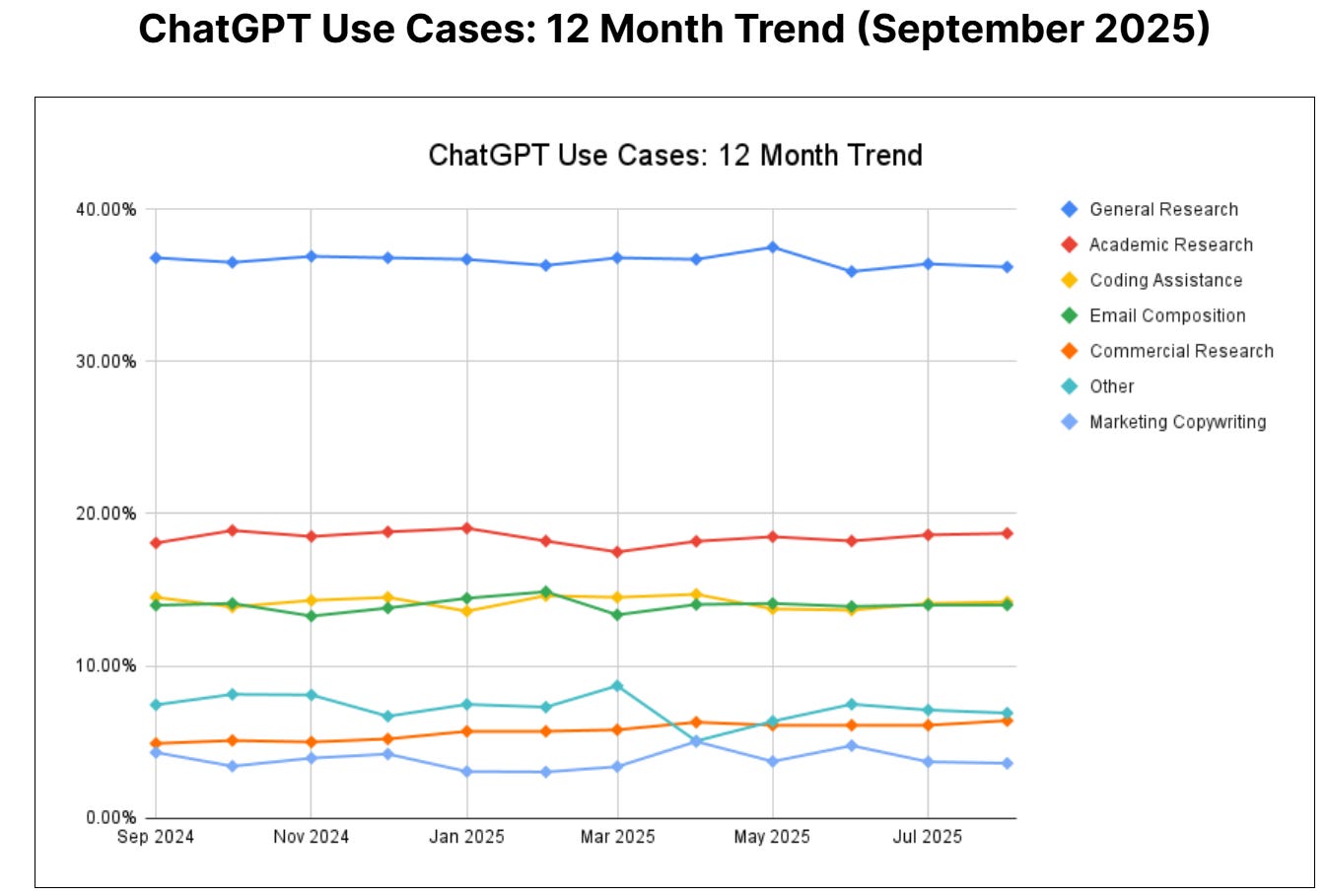

Not all users are created equal in social. That’s why, even with ChatGPT boasting >700M weekly active users (“WAUs”), I’m not convinced OpenAI can translate that scale into sticky, repeat engagement for its new Sora app. The way people use ChatGPT has little in common with how they interact on leading social platforms, and as I’ve argued before, AI works best as a layer within an experience, not the entire experience. Sora is effectively trying to manufacture a brand-new habit around a niche AI-first use case, which I see as an uphill battle.

Enter Snap.

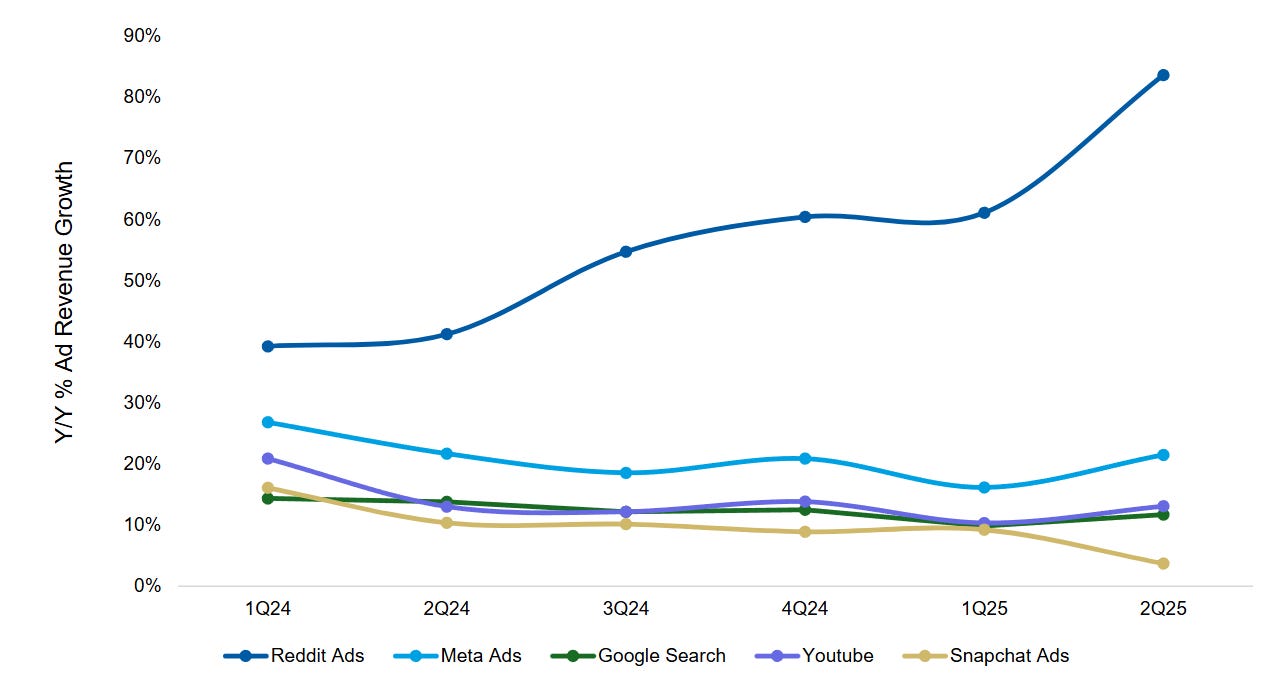

Snap, the business, is a disaster. Ad revenue is growing single digits, margins are a joke compared to its peers, and the very little money it does make is all paid out to Evan & Co in the form of egregious stock-based compensation (hence the comment about it being Spiegel’s personal ESOP). If you want to throw up…just know they’ve paid out ~$8 billion in stock comp since 2018 compared to today’s market cap of $13B.

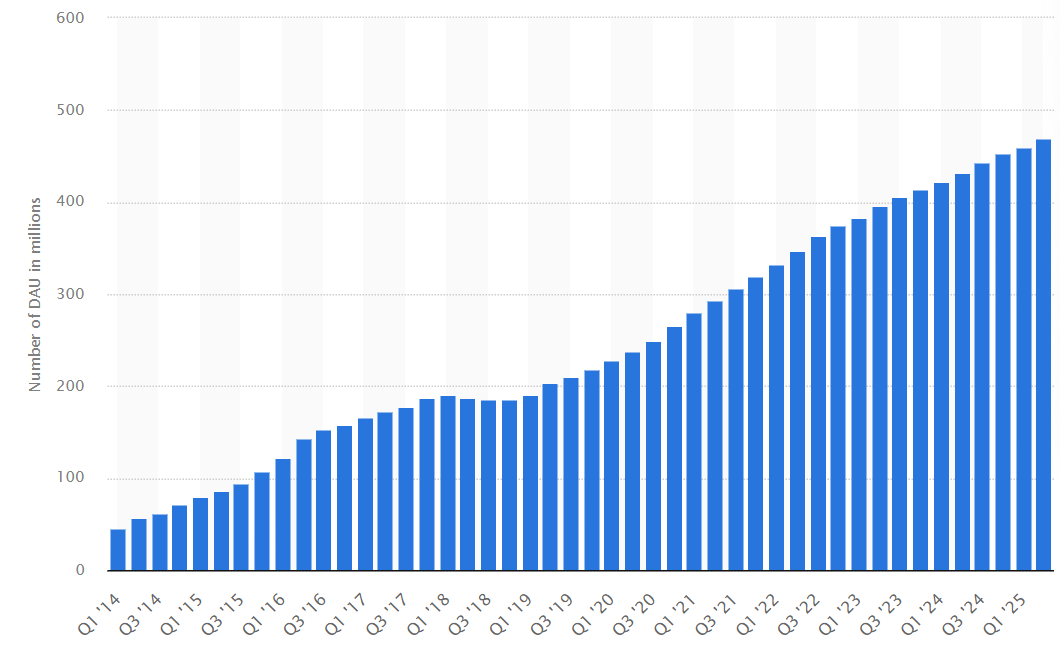

But Snapchat the social app, is still thriving. Nearly 1 billion people use Snapchat monthly and that’s still growing +7% y/y. Daily Active Users (“DAUs”) is nearing 500 million and growing +9% y/y. Spotlight, Snapchat’s native viral short-form video tab, reached more than 550 million MAUs in Q2 2025, with time spent growing +23% y/y. Snapchat’s AR lenses are used 8 billion times per day. And Snapchat+, Snap’s premium subscription offering that was launched in late 2022, is growing +64% y/y with 16M paid subscribers generating ~$700 million in annualized revenue.

Snapchat has also shown consistent product innovation, beginning with the introduction of ephemeral Stories in 2013 (which are now an industry standard), pioneering Lenses and Filters in 2015 (now heavily augmented reality based), recognizing the value of and integrating Bitmoji in 2016, and then launching Snap Maps in 2017 (which Instagram copied a few months ago).

It’s worth noting that Snap has managed this in an intensely competitive attention economy…going up against deep-pocketed rivals like Meta, which has systematically copied Snap’s innovations, and TikTok, which has rapidly scaled to dominate user time spent.

In fact, I believe Snap’s failings as a public company has led to Snapchat’s scale becoming underrated. The only apps that reach a larger audience than Snapchat’s 1 billion MAUs are either owned by Meta, Alphabet, or China.

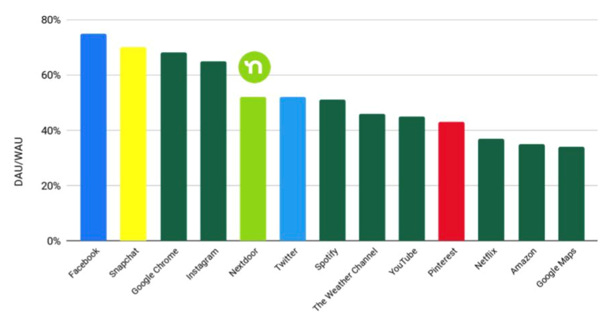

And that’s on a monthly basis. The real value with Snapchat is the daily habitual nature of the app, driven by its core use case, messaging/communication. On average, users open the app ~40 times per day and spend ~30 minutes per day communicating with friends, scrolling the Spotlight tab, and interacting with augmented reality filters and lenses.

Snapchat’s conversion of MAUs to DAUs is also best in class, trailing only Facebook and WhatsApp in the US (TikTok US not shown below but is ~50% MAU→DAU).

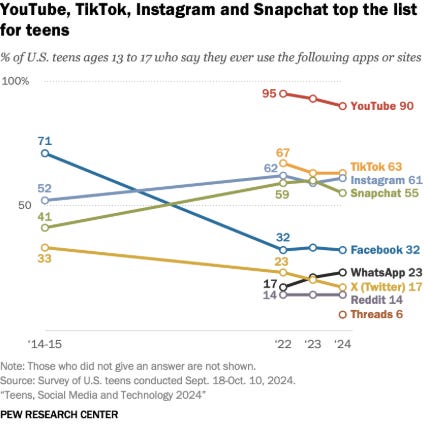

Snapchat also scores extremely well with the highly valuable and highly coveted Gen Z cohort, with >50% of US teens saying they use the app. Gen Z are the spenders of tomorrow and most likely demographic to adopt/use/interact with AI.

Snapchat’s global scale, habitual engagement, distinctive user interactions, and coveted demographics make it a unique strategic asset — undervalued today and, in my view, an ideal distribution platform for OpenAI in the looming “Slop Wars.”

The combination carries compelling strategic logic. Below are my high-level notes on how the two could complement one another and unlock value by leveraging each other’s strengths.

For consumers: Snapchat becomes the most AI-native social app, with creation, communication, accessibility, and AR experiences that are differentiated and daily-relevant.

For advertisers/partners: OpenAI unlocks creative efficiency, better ad performance, safer placement, and new commerce surfaces, all of which are directly tied to revenue expansion.

Consumer / User Symbiosis

Distribution + consumer product DNA for OpenAI

Snap gives OpenAI a massive, young, highly engaged top-of-funnel: ~500 million DAUs and ~1 billion MAUs with strong short-video/AR surfaces (Stories, Spotlight) where AI agents, creative tools, and commerce can live day-to-day.

Snapchat’s users are already used to engaging with content in the ways that OpenAI hopes they engage with Sora.

AI-native creation tools in the camera

Seamless integration of OpenAI models (text, image, voice, video) directly into Snapchat’s camera and Lens ecosystem.

Increases user engagement time and uses Snap’s differentiation to be competitive vs YouTube/TikTok/Instagram for new AI products.

Conversational social experiences

LLM powered “co-creators” inside group chats and Stories: suggest replies, generate memes, draft content.

Builds on Snap’s existing MyAI bot, but supercharged with frontier-model capability.

Creates new daily use cases that make Snap more “sticky” for ~500 million DAUs.

Next-gen AR hardware utility

OpenAI models embedded in Spectacles or future AR devices. Both companies have hardware aspirations (OpenAI acquired io Products in May 2025 and Evan has routinely called Snap a “camera company”).

Allows them to compete in the future with similar offerings like Meta Raybans, MetaQuest, Apple Vision Pro, etc.

Premium subscription upsell

Snapchat+ enriched with advanced AI features: personalized lenses, premium creative packs, custom avatars/voices.

Helps Snap grow its high margin subscription business while leveraging OpenAI’s models.

Advertiser / Partner Improvements

Better relevance/creative automation (LLM-assisted targeting, asset generation, incremental conversion measurement)

LLMs and image/video models produce ad copy, creative variants, and localized assets.

Cuts advertiser production costs; improves ad quality and fit for Snap’s youth-skewed audience.

Can increase ARPU by higher auction bid density and CTR lift.

Hyper-personalized targeting & optimization

AI-driven models can predict intent and deliver more relevant ads.

Improves ROI for advertisers.

AI-assisted SMB onboarding

Self-serve advertisers, a growth segment for Snap, could use “AI ad assistants” that build campaigns end-to-end (copy, targeting, creative).

Reduces friction for small businesses entering Snap ads manager.

Commerce and conversational shopping

Retailers could deploy AI shopping assistants directly within Snap (chatbot storefronts inside Spotlight/Stories).

Unlocks higher margin commerce tie-ins (affiliate, transaction fees), diversifying Snap’s ad-dependent model.

This aligns with OpenAI’s announcement this week of “Buy it in ChatGPT: Instant Checkout and the Agentic Commerce Protocol” which allows users to purchase Shopify/Etsy products with instant checkout directly in ChatGPT.

Brand safety and compliance

OpenAI moderation models layered into Snap’s ad review pipeline = lower risk of harmful or policy violating creative.

Important for big brands wary of adjacency on teen-heavy platforms.

Financial / Operating Upside

Significant cloud computing synergies

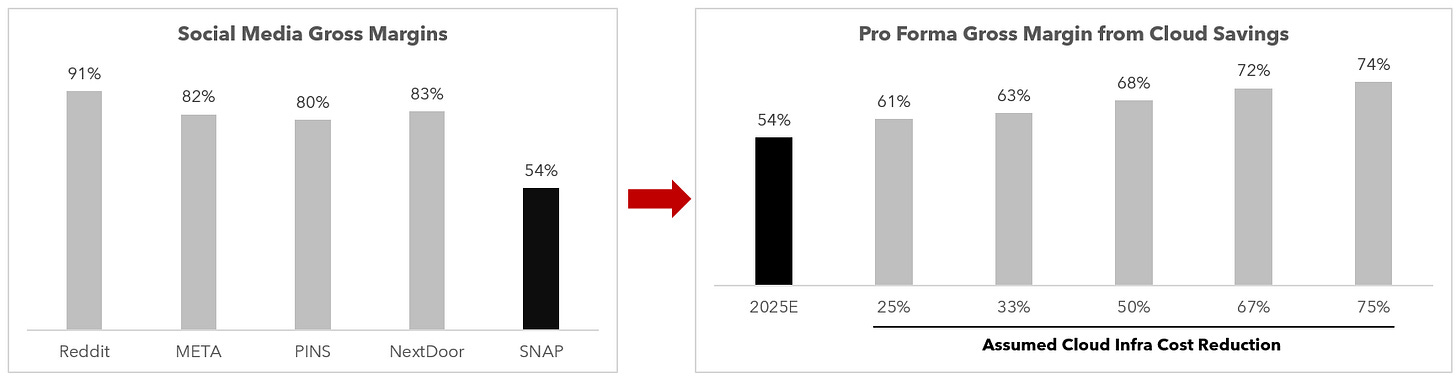

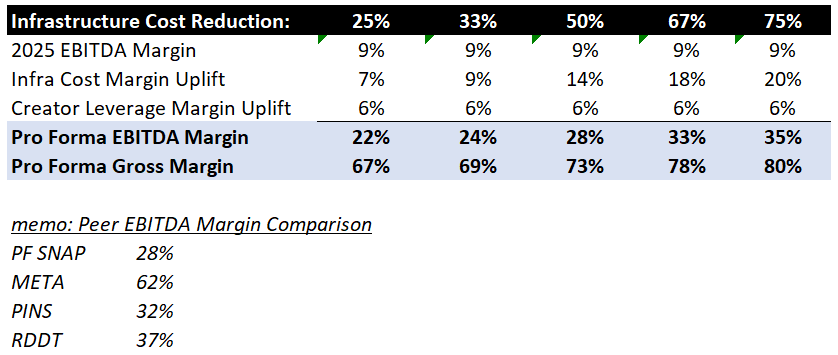

Snap’s 54% gross margin is significantly below social media peers at 80-90% mainly due to cloud computing/infrastructure costs associated with their video-heavy content.

In September 2025, OpenAI signed a 5-year $300B cloud computing contract with Oracle. This is in addition to ongoing commitments with Microsoft’s Azure, and the ~$22 billion owed to CoreWeave. The Oracle contract alone is ~$60 billion per year and dwarfs Snap’s ~$1.5 billion in LTM cloud infrastructure spending. OpenAI’s purchasing scale would likely result in significant negotiating leverage and associated savings for Snapchat.

When Microsoft thought about acquiring Pinterest in 2021, part of the strategic rationale was synergies associated with transitioning Pinterest from Amazon Web Services (“AWS”) to Microsoft’s owned IaaS platform, Azure.

~90% of Snap’s non-cancellable cloud commitments are due by YE 2027, implying that a post-deal conversion is definitely financially possible.

Assuming a 25-75% reduction in Snap’s cloud costs would result in a gross margin uplift of 7-20%, bringing them closer to peers

Creator economics, cost per impression, and advertising partner leverage

Snap’s content supply (Spotlight, Discover, Creator Stories) is expensive to maintain. The company shares ad revenue or pays minimum guarantees to attract creators and so ~40% of Snap’s cost of revenue is spent on these arrangements.

If Snap creators (or Snap itself) can leverage OpenAI’s Sora video models it could lead to a creator monetization rebalancing and reduce costs

Lower marginal cost per video: producing high-quality, 10–30 second Spotlight-style clips goes from hours/days of human effort to minutes of prompt engineering. Human creators could use Sora 2 to generate clips faster, boosting volume.

Lower effective cost per impression paid to creators: Snap can widen supply without increasing payouts proportionally, since a larger portion of inventory can be AI-augmented or co-created.

Reduction in Snap’s dependence on direct subsidies (e.g., the hundreds of millions spent on Spotlight payouts since 2020) to keep content flowing.

If you assume a 75% reduction in infrastructure costs, and a 50% reduction in the percent of revenue shared with creators, the tailwind to gross margin and EBITDA margin is ~26%, which would bring Snap’s pro forma margins in-line with peers at ~80% and ~35%, respectively.

Revenue opportunities

Ad inventory expansion

Advertisers need vertical short-form creative at scale; OpenAI models could generate localized, product-specific video ads with Snap’s AR lenses integrated.

More video supply = more impressions = lower unit acquisition cost for advertisers, but higher total revenue for Snap if the auction remains competitive.

Globalization & localization

Snap could instantly localize content (languages, cultural cues) via multimodal AI, which reduces reliance on costly regional creator programs.

This matters in under-monetized geographies where Snap has large absolute user numbers but is still trying to scale monetization from an extremely low ARPU starting point (e.g., India, Latin America).

Benefit to OpenAI/advertiser

OpenAI: A 1 billion user consumer-scale showcase for multimodal models, tens of billions of monthly video impressions produced/augmented by OpenAI tech.

Advertisers: More supply, richer formats, faster iteration, improved campaign ROI.

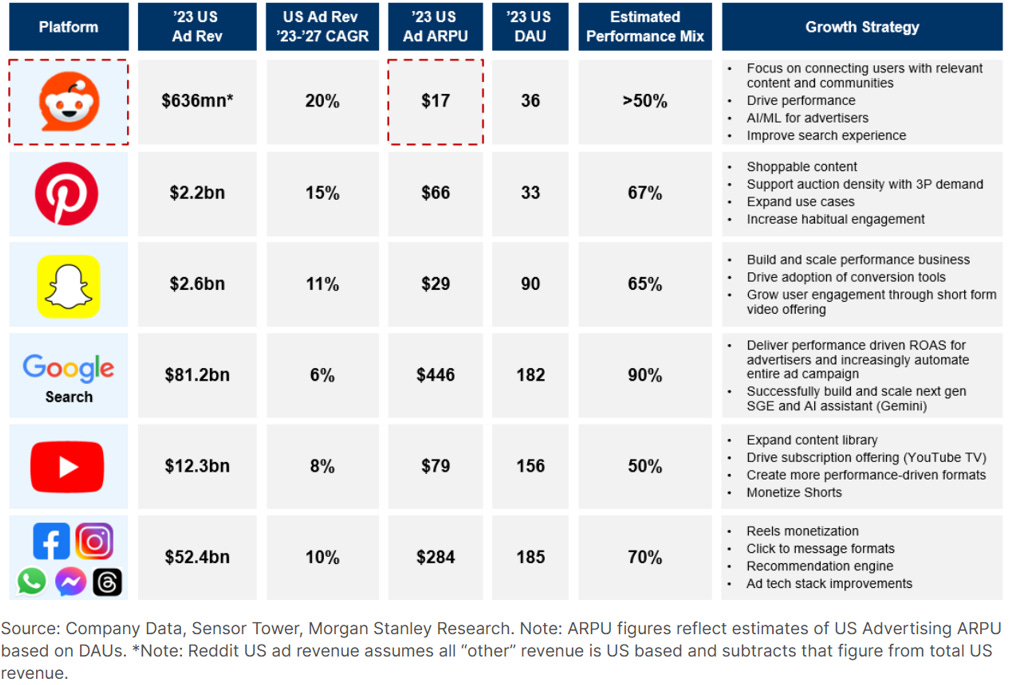

Snap’s struggles as a business can be traced back to its inability to demonstrate effective ROI for advertisers. The above examples are ways to improve that ROI and close the monetization gap vs peers. The below ARPU numbers are dated but still illustrate how under-monetized Snap is, even in its most mature market (the US). If you were to run these numbers internationally, or on a total time spent basis rather than just users, the picture would show Snap is even more hilariously under-monetized.

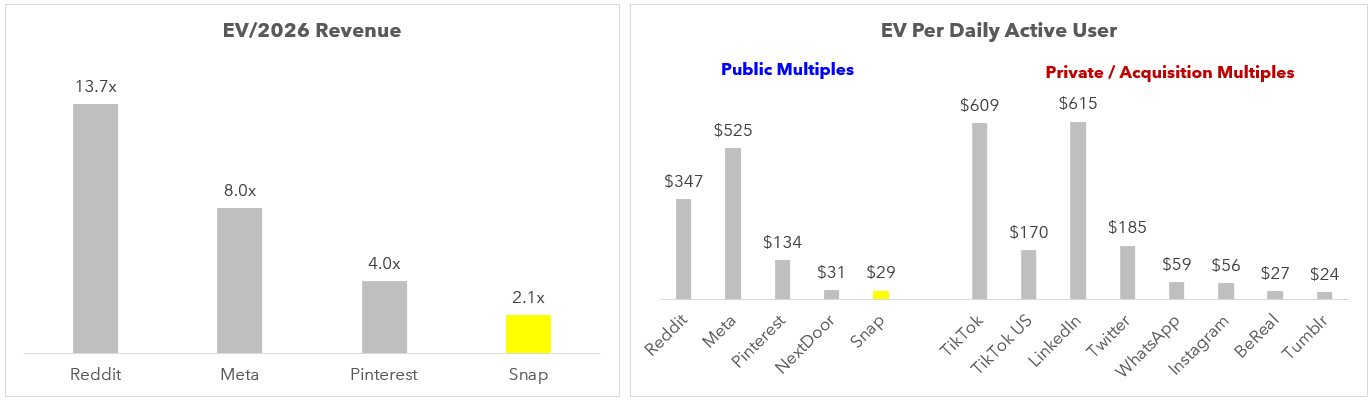

Given Snap’s anemic growth and pathetic financial profile, it’s easy to view the stock as expensive at ~25x a heavily adjusted EBITDA figure — particularly when larger, more profitable peers like META, GOOGL, and PINS trade below 12x EBITDA. However, given the user scale, non-optimized margins, and strategic value, I think Snap is fairly cheap. Here’s a look into why.

Despite a high headline EBITDA multiple, Snap trades at a deep discount on an EV/Revenue basis (given weak growth and lower margins). OpenAI would be able to unlock revenue and cost synergies that are not available as a standalone public company. In addition to the gross margin synergies mentioned above, there would be operating expense benefits from a reduction in duplicative costs.

On an EV / DAU basis, Snap is the cheapest “social media” company in the public markets, trailing even the subscale Nextdoor which has <$300 million in revenue, is growing low single digits, and has negative EBITDA margins.

Looking at historical social media acquisitions also shows that Snap is on the low end of the historical valuation range.

Snap

EV: $13.5B

Users: 469M DAUs / 932M MAUs

EV / DAU: ~$29

EV / MAU: ~$15

~2.1x Revenue

Twitter (2022 acquisition)

EV: $44B (3x Snap)

Users: 238M monetizable DAUs (half as many as Snap)

EV / DAU: ~$185 (6x Snap’s DAU multiple)

~8.5x Revenue (4x Snap)

LinkedIn (2016 acquisition)

EV: $26.2B (2x Snap)

Users: 106M MAUs (88% less than Snap)

EV / MAU: ~$246 (17x Snap’s MAU multiple)

~7.0x Revenue (3x Snap)

WhatsApp (2014 acquisition)

EV: $19B (40% more than Snap)

Users: 450M MAUs (half of Snap)

EV / MAU: ~$42 (3x Snap’s MAU multiple)

TikTok US (2025 sale)

EV: $14B (Same as Snap)

Users: 82M DAUs (80% less than Snap)

EV / DAU: ~$170 (6x Snap’s DAU multiple)

BeReal and Tumblr never achieved anywhere near the global scale, staying power, or social influence that Snap has.

If you refer back to the high-level math in the prior section where I outlined infrastructure and creator cost synergies you can make the case that Snap is currently trading at ~6.5x a pro forma EBITDA number that could be achieved through a combination with OpenAI. On that basis, even a 100% premium to today’s price would imply an EBITDA multiple of only ~13x, which is in-line with public peers that have more optimized margins.

A 100% premium for Snap = $27 billion enterprise value, or ~5% of OpenAI’s latest $500 billion valuation. That’s a relatively modest price to pay for a globally scaled, consumer-facing, purpose-built social distribution platform in the age of AI.

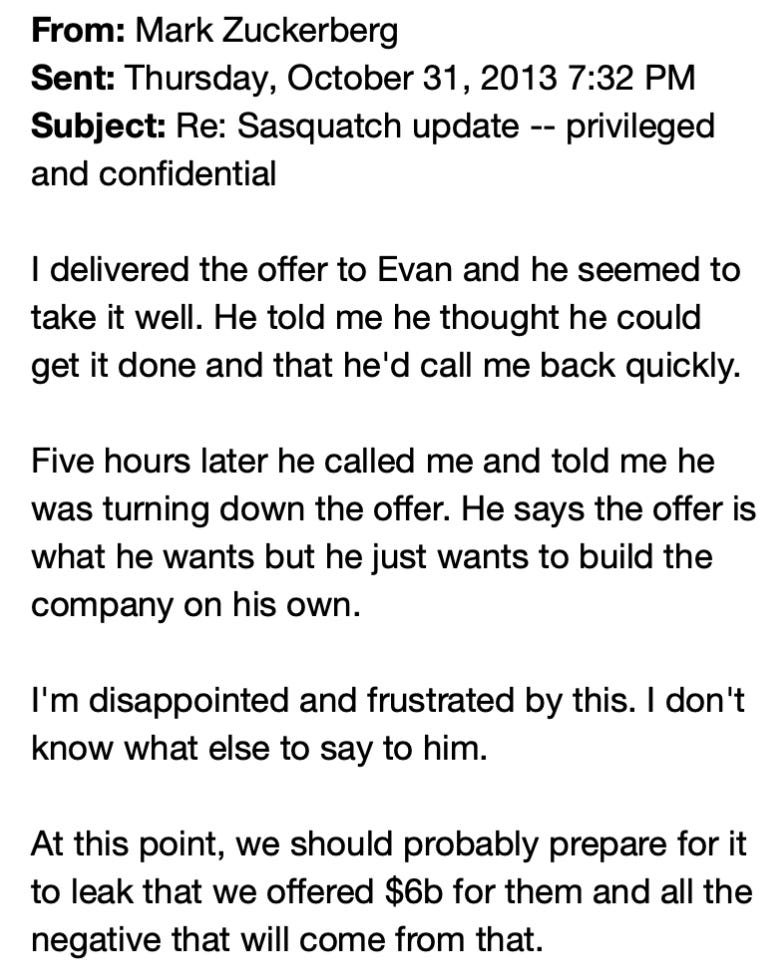

Note: Evan holds supervoting rights, meaning no sale can happen without his approval. He’s resisted selling before, including turning down Facebook’s $6 billion offer in 2013. That said, a potential deal with OpenAI feels more palatable: rather than surrendering to a rival tech giant that already “won” (i.e., Meta/Alphabet), he’s aligning with a partner that strengthens his hand to compete against the incumbents. A nice big “F U” to Zuck. Also, horizontal antitrust risk is modest (OpenAI isn’t a social-ads incumbent).

Random Notes:

On the topic of social media, here’s a very long unrelated tweet thread about Pinterest from 2021 that was right about some things and wrong about others. See here and here and here and here.

Disclaimer

The content provided on this Substack is for informational and educational purposes only. Nothing herein constitutes financial, investment, legal, or tax advice. I am not a licensed financial advisor, broker, or investment professional. Any opinions expressed are solely my own and should not be construed as recommendations to buy, sell, or hold any securities or financial instruments.

Investing involves risk, including the potential loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. I make no guarantees as to the accuracy, completeness, or reliability of any information presented. Past performance is not indicative of future results.

By reading this content, you agree that the author is not responsible for any financial losses or other damages that may result from actions taken based on the information provided.

This write up is the perfect mix of logic and math on a shitco that has burned everyone’s money so far.

Perfect yolo material, I say.

I think it's a fun theory (if they actually want the user base) - but even if they wanted to the actual mechanics are hard. Would need a 15bn+ cheque and they don't have the money. Huge raises required next year to just meet the compute bill even with the NVDA cash. They can't use stock and aren't ready to be public just yet.